“Driving SaaS Revenue: The Impact of Sales-Based Financing Strategies”

by siteadmin

In today's rapidly expanding SaaS industry, startups often grapple with the challenge of securing the necessary capital to fuel their growth. This is particularly true for B2B SaaS companies, as they often face skepticism from traditional investors. However, with strategic planning and innovative financing strategies, SaaS companies can unlock new avenues to boost their revenue. In this article, we'll delve into various strategies employed by SaaS firms to drive revenue, with a special focus on the transformative impact of Sales-Based Financing.

SaaS Landscape and Revenue Imperatives

The SaaS landscape is characterized by its subscription-based software delivery model, offering businesses the agility to access applications via the web or dedicated apps. Key drivers of SaaS adoption include reduced upfront costs, scalability, and efficient customer relationship management. To drive revenue, SaaS companies must master pricing strategies that resonate with their target audience.

Pricing Strategies for Revenue Growth

Pricing strategies play a pivotal role in revenue optimization for SaaS companies. With the flexibility of subscription-based pricing models, often associated with terms like "BNPL SaaS" and "B2B BNPL," SaaS firms can cater to the budgetary needs of various businesses. These flexible subscription models, often discussed in the context of "non dilutive capital" and "non dilutive funding startups," enable businesses to access valuable software services while maintaining control over cash flow.

Operational Efficiency with SaaS

SaaS applications are revered for their accessibility via web browsers or mobile apps, eliminating the need for expensive hardware investments. Terms like "BNPL SaaS" and "B2B BNPL" highlight the flexibility of SaaS subscription models, allowing businesses to streamline operations, enhance customer relationships, and optimize their workflows. However, SaaS applications are not without their challenges, as they may be susceptible to external factors like internet outages, a point of concern in the era of cloud-based services.

Equity Strategies for Sustainable Growth

The quest for revenue growth and profitability often leads SaaS businesses to explore innovative equity strategies. One such strategy is Revenue-Based Financing (RBF), a financing model gaining traction among startups due to its non dilutive nature. "Non dilutive funding startups" are increasingly turning to RBF as an alternative to traditional sources of capital, such as venture capital or bank loans. The allure of RBF lies in its ability to provide much-needed capital without requiring businesses to relinquish equity or take on additional liabilities.

Growth Challenges and Financial Needs

SaaS companies are no strangers to significant costs associated with research and development, marketing, and customer acquisition. To remain financially viable, these companies must efficiently manage recurring revenue streams while closely monitoring key performance indicators (KPIs) like Monthly Recurring Revenue (MRR), Lifetime Value (LTV), and Customer Acquisition Cost (CAC).

Untapped Sources of Working Capital

To address the financial challenges inherent to the SaaS sector, companies are increasingly exploring untapped sources of working capital. Three such sources, True Sale Based Financing (TBF), Customer-Financed Growth, and SaaS R&D Tax Credits, are gaining prominence.

Doug Merritt, prior CEO of Splunk, says

"Ratio offers a powerful, often untapped, strategy for SaaS companies to accelerate sales and growth financing. In the past this has only been available to the largest companies in the world."

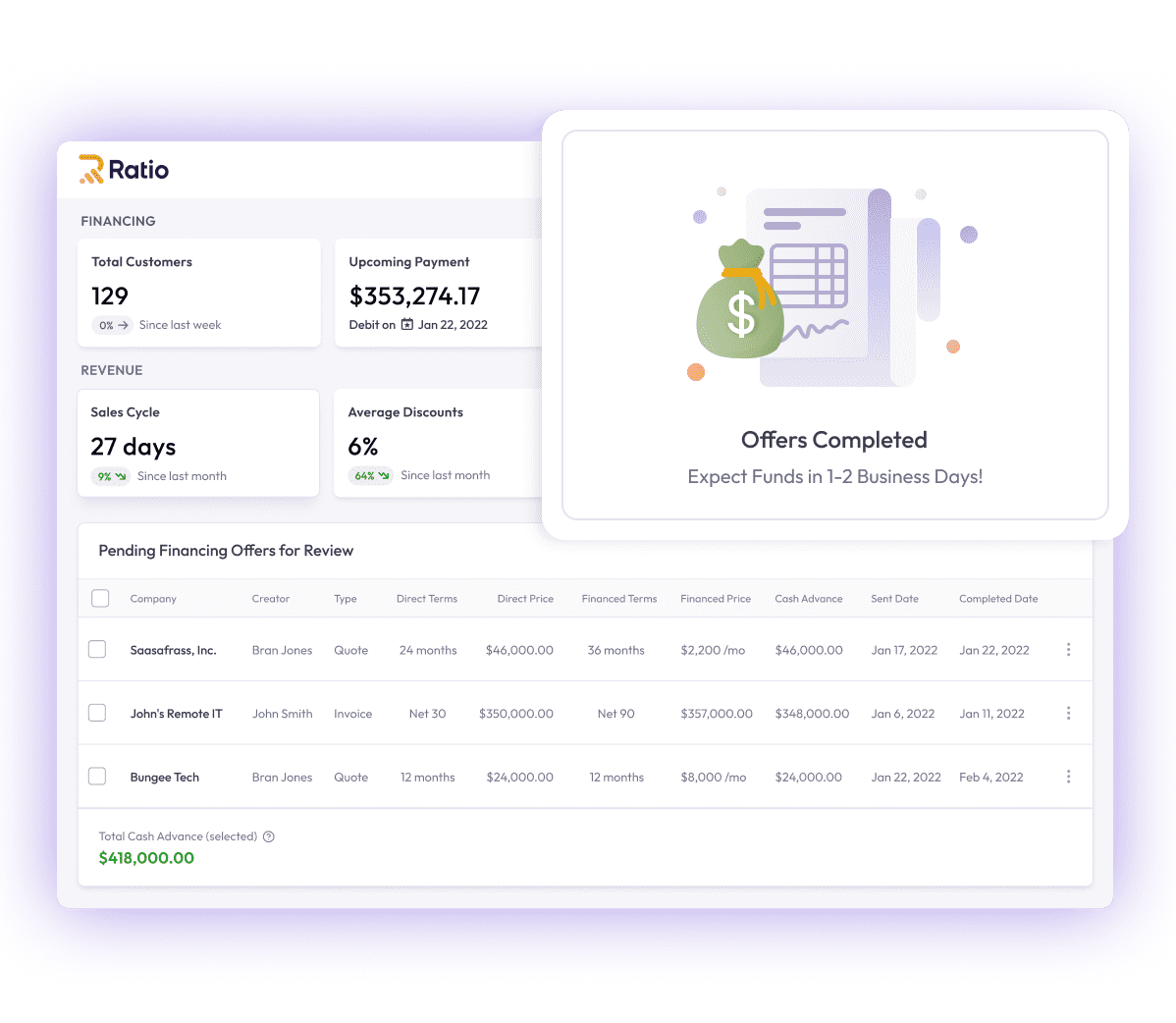

True Sale Based Financing (TBF)

TBF is emerging as a compelling option for SaaS companies seeking rapid capital infusion without compromising equity or adding to their financial liabilities. TBF involves the transfer of valuable assets, including intellectual property and contracts, in exchange for immediate capital. This form of financing aligns perfectly with the concept of "non dilutive capital."

Customer-Financed Growth

Customer-financed growth strategies leverage the existing customer base to fund business operations and expansion. Innovative approaches such as Matchmaker Models, Pay-in-Advance Models, Subscription Models, Scarcity Models, and Service-to-Product Models allow businesses to harness customer resources for revenue growth.

SaaS R&D Tax Credits

SaaS companies aiming for innovation can leverage Federal R&D Tax Credits, offering significant reductions in tax liabilities. These credits, representing a form of "non dilutive funding," can reach up to 13% for qualifying developments. Investment in research and development not only drives technological progress but also enhances a company's competitive position.

Choosing the Right Financing Strategy

Among these untapped sources of working capital, TBF emerges as an attractive choice for SaaS companies with recurring revenue contracts. Partnering with a reputable TBF provider, such as "Ratio Trade," streamlines the process of acquiring working capital, supporting the growth objectives of SaaS businesses.

As shared by Guru Experience,

"Ratio is unequivocally the best RBF vendor we have ever worked with. Not only was Ratio able to work with our unique needs, but we were also able to get more funding with better terms through them. Ratio's innovative “True Sale” product is a game changer, delivering key business value that we don’t see elsewhere. Furthermore, Ratio’s Boost product offers an embedded Buy-Now-Pay-Later (BNPL) option, which is very unique. We are excited to work with Ratio to accelerate our revenue using Boost."

Conclusion: Financial Innovation in SaaS Revenue Growth

In the fiercely competitive SaaS landscape, innovative financing strategies hold the key to driving revenue and achieving sustained growth. SaaS companies must evaluate their unique financial needs and explore these untapped sources of working capital to navigate the dynamic landscape successfully. Sales-Based Financing, notably RBF, offers a path to capital that aligns with the long-term goals of SaaS enterprises.

Do you want to learn more about how Sales-Based Financing can empower your SaaS business? Schedule a demo with Ratio Trade today and unlock the working capital you need to thrive.

In today's rapidly expanding SaaS industry, startups often grapple with the challenge of securing the necessary capital to fuel their growth. This is particularly true for B2B SaaS companies, as they often face skepticism from traditional investors. However, with strategic planning and innovative financing strategies, SaaS companies can unlock new avenues to boost their revenue.…

Recent Posts

- Kevin A. Adamson, P.C. – Your Trusted Duluth Wrongful Death Attorney

- Expert Cleaners Lexington Announces Commitment to Safe, Sustainable Cleaning Practices, Expanding to Georgetown, KY

- Expert Cleaners Lexington Announces Commitment to Safe, Sustainable Cleaning Practices, Expanding to Georgetown, KY

- How to Find Roses for Every Occasion

- Expert Cleaners Lexington Provides Insight into Commercial Cleaning Services and Best Practices for Office Maintenance